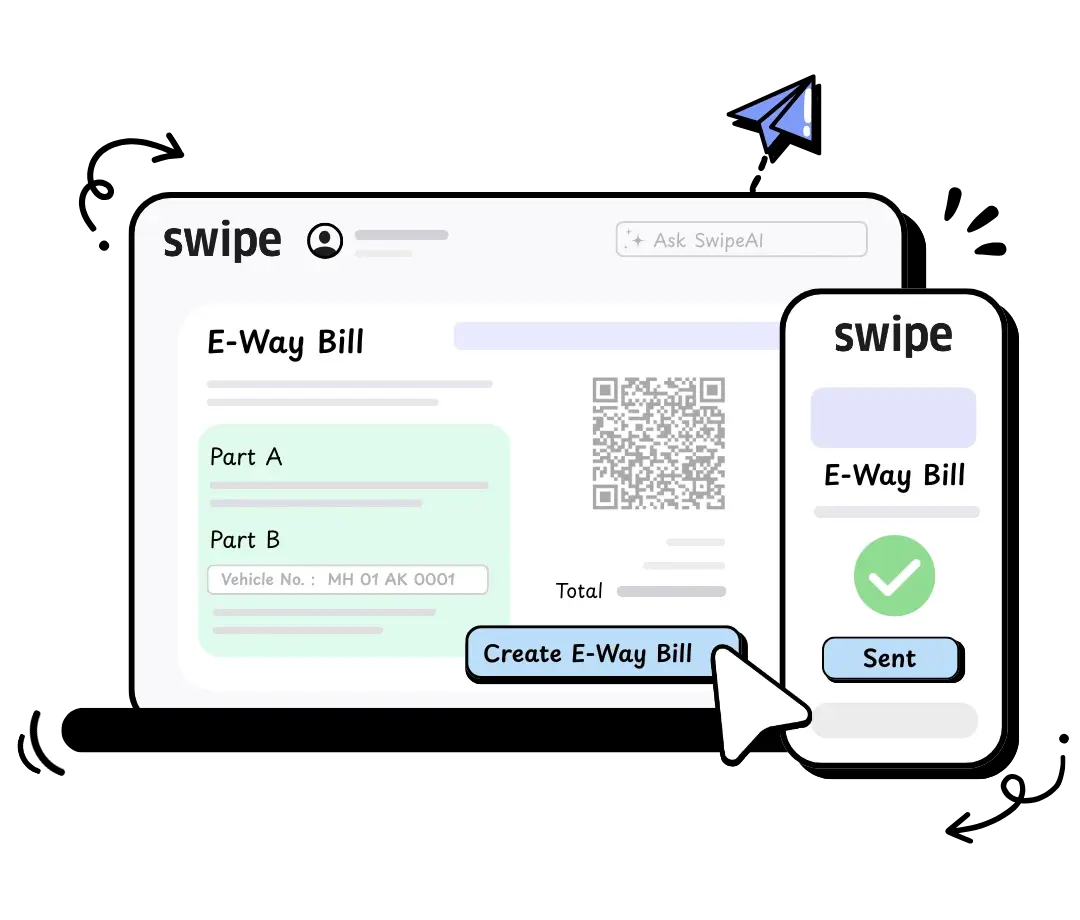

E-Way Bills in Seconds vs 45 Minutes.

E-Way bills? We’ve made it instant. Swipe handles the speed. You have to try it to believe it.

Trusted by 20,00,000+ businesses

No more waiting 45 minutes. Generate E-Way bills instantly, right from Swipe.

Wrong pin code? Missing details? Our AI spots and fixes issues before you hit submit.

Customer info, vehicle numbers, distances — pre-filled so you can fly through forms.

Get instant alerts if something’s off. No surprises, no rejections.

Create an invoice, generate an E-Way bill — all in the same flow.

Create, download, and share E-Way bills on the go. Works beautifully on your phone.

You don’t need training. If you’ve used any app before, you’re good to go.

Invisible security. Unbreakable trust.

Your data stays private. Always encrypted.