In April 2019, a new tax payment process was introduced to make tax compliance easier for composition dealers. This new system introduced Form CMP-08, which replaced the previous quarterly GSTR-4 filing for composition dealers. In this blog, we'll break down what Form CMP-08 is, who should file it, the due dates, the penalties for late filing, and how to fill it out.

Form CMP-08 is a special statement and challan used by composition dealers to declare the summary of their self-assessed tax payable for a specific quarter. It also serves as a means to make tax payments. A composition dealer is someone registered under the composition scheme for both goods and services. In addition to Form CMP-08, they also need to file an annual return using the revised Form GSTR-4 by April 30 following the end of the fiscal year.

Composition dealers, who have opted for the composition scheme, are required to file Form CMP-08 to deposit payments every quarter. There are two types of taxpayers who can use CMP-02 to opt into the composition scheme:

Manufacturers, and retailers with an annual aggregate turnover of up to Rs. 1.5 crore (or Rs. 75 lakhs for special category States, excluding Jammu & Kashmir and Uttarakhand) in the previous fiscal year. However, some exceptions include the manufacturers of certain goods and those making inter-state supplies or supplying non-taxable goods.

Those meeting the conditions specified in Notification Number 2/2019 Central Tax (Rate) dated 7th March 2019, with an aggregate annual turnover of up to Rs. 50 lakh in the previous fiscal year.

Log in to the GST portal.

On the dashboard, navigate to the CMP-08 tile.

Select the relevant financial year and choose the return filing period for the quarter you're interested in.

Click on 'SEARCH.'

Now, click 'PREPARE ONLINE' to access the CMP-08 form for payment of self-assessed tax.

.png)

In the CMP-08 form, proceed to fill in the details in Table 3.

Enter the summary figures of the value of supplies and tax payable for the three-month period.

If you're filing late and there's interest to be paid, enter that amount.

Tick the checkbox for 'File Nil GST CMP-08' if:

You had no outward supplies during the selected return period, and therefore no tax is payable.

You have no output tax liability because you had no inward supplies on which tax is payable on a reverse charge basis, including imported services.

You have no other tax liability.

After entering the details, click on 'SAVE' to save your input.

To ensure the accuracy of your input, click on 'PREVIEW DRAFT GST CMP-08.'

Review the details you've entered in the form.

Now, it's time to make your tax payment.

You can use the cash balance available in your electronic cash ledger for payment.

If your cash balance is insufficient, you can click on 'Create Challan' to choose either NetBanking or NEFT.

Confirm the details you've submitted by checking the declaration statement box.

Submit your CMP-08 using electronic verification code (EVC) or digital signature (DSC).

You'll receive a message confirming the filing of CMP-08 along with a unique ARN (Application Reference Number) generated by GSTN.

Additionally, you'll receive an SMS and an email on your registered mobile and email ID.

Form CMP-08 should be filed quarterly, and the due date is on or before the 18th of the month following the quarter. For example, if you're filing for the January-March 2021 quarter, the due date was April 18, 2021.

If you fail to submit Form CMP-08 by the due date, you will be subject to a late fee of Rs. 200 per day for each day of delay, split into Rs. 100 under CGST and Rs. 100 under SGST. This late fee accumulates to a maximum of Rs. 5,000 from the due date to the actual filing date. Additionally, if CMP-08 for two consecutive quarters goes unfiled, your e-way bill generation will be blocked. To unblock it, you'll need to apply to the jurisdictional tax official and file all pending forms for previous quarters.

Firstly, enter your GSTIN (Goods and Services Tax Identification Number).

Note: This unique identification number is essential for tax purposes.

After entering your GSTIN, you'll notice that some primary information is auto-filled. This includes your legal name and trade name.

Note: These details help identify you as a taxpayer.

Additionally, the same statement will be updated for the ARN (Application Reference Number) and the date of filing.

Note: This information is crucial for tracking and verification purposes.

The third table in the form is where you provide details about your self-assessed tax liability. This includes

Outward supplies on which tax is payable by you.

Inward supplies on which tax is payable on a reverse charge basis

Cases of imports that are relevant to your tax liability.

Report the tax payable on these transactions.

If any interest has been paid, it should also be mentioned.

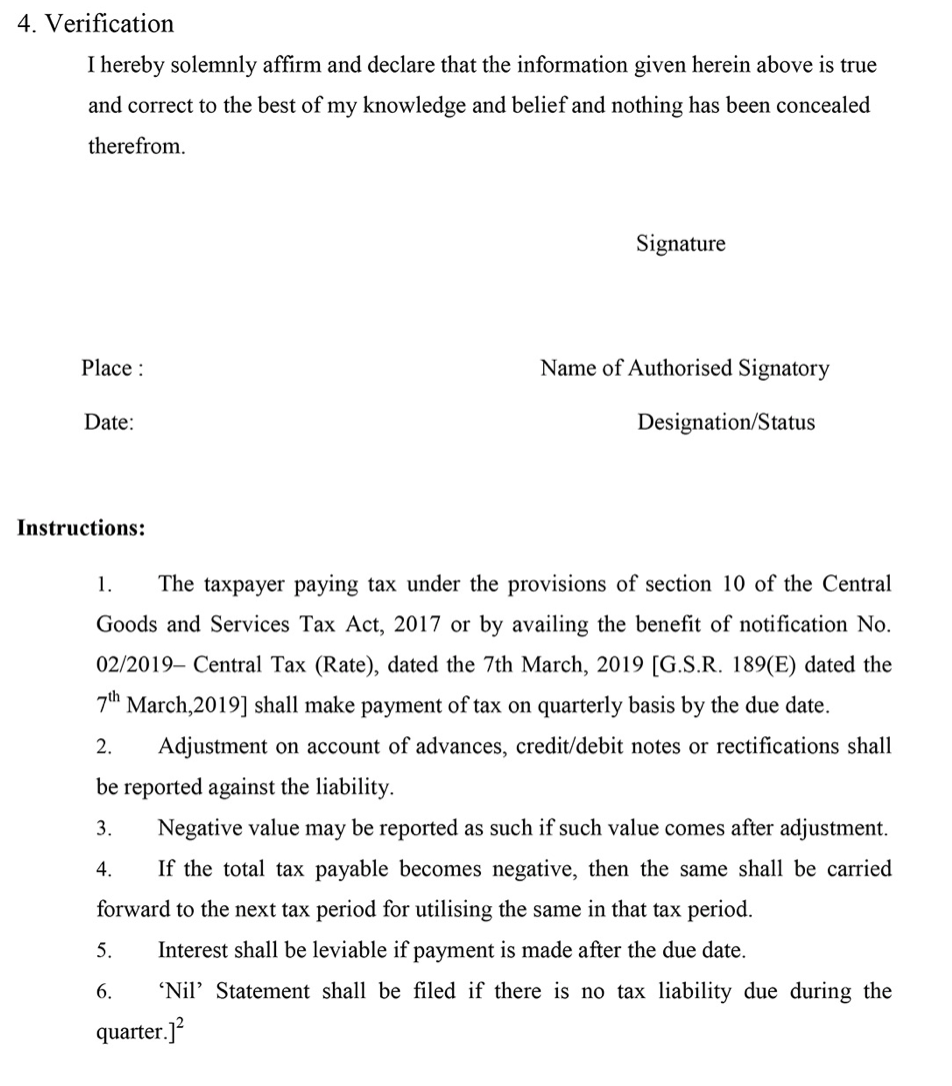

Now, you need to confirm that you have reviewed and verified all the details that have been entered in the form. This is essentially your declaration that the information provided is accurate.

Note:

If you have no tax liability for a specific quarter, you can file a 'NIL' return, which can even be done via SMS.

Missing the filing due date will result in interest and penalties.

Tax liabilities include adjustments related to advances, credit notes, debit notes, or any rectifications.

In conclusion, Form CMP-08 simplifies tax compliance for composition dealers. It's crucial to file it on time to avoid penalties and e-way bill issues. Keep track of your due dates, fill out the form accurately, and ensure you meet the requirements of the composition scheme. If you have any doubts or need assistance, it's always a good idea to consult with a tax professional.